A Risk Management Information System (RMIS) is a software platform designed to support organizations in identifying, assessing, monitoring, and mitigating various risks. By centralizing data and automating key processes, RMIS enables companies to manage risks more effectively and make informed decisions. From compliance and claims management to environmental risks, RMIS offers a suite of tools to handle the complexities of risk management in today’s fast-paced business environment. This article explores the functionalities, benefits, and applications of RMIS, as well as its impact on modern businesses across sectors.

1. What is RMIS?

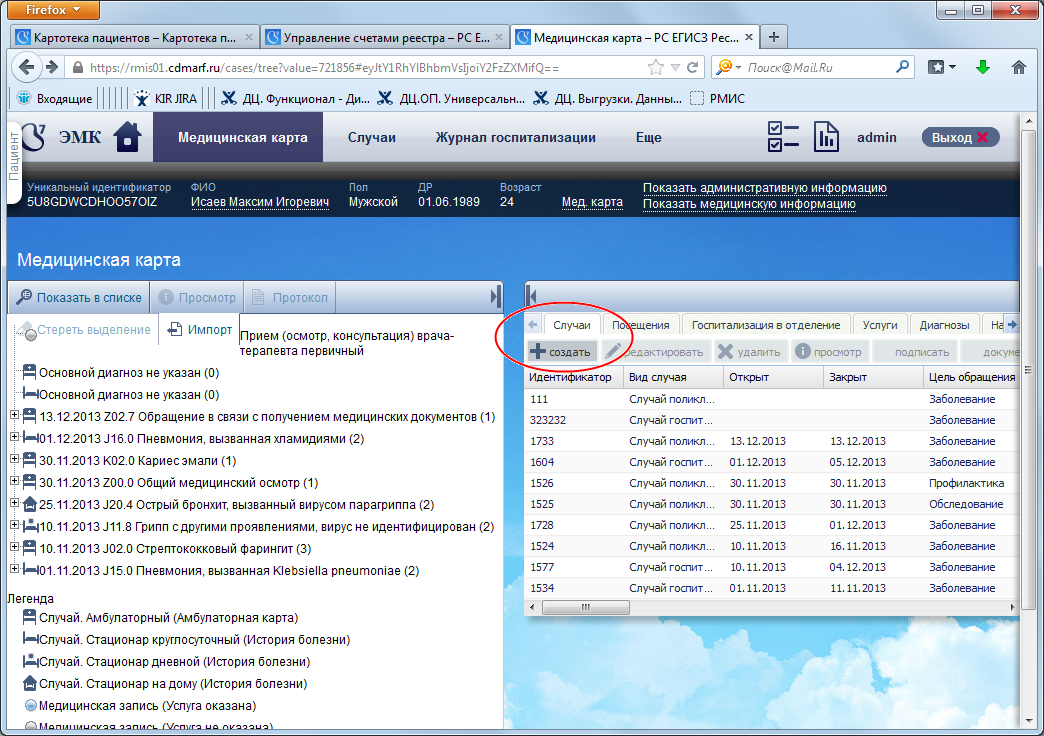

RMIS stands for Risk Management Information System, a specialized platform that enables businesses to streamline the risk management process. With RMIS, companies can collect and analyze data related to claims, safety, insurance, compliance, and more, centralizing these key functions into a single system. An RMIS is generally integrated into an organization’s larger information technology infrastructure and can communicate with other enterprise software, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems, allowing for seamless data flow.

2. Core Features of RMIS

RMIS platforms come with a range of features, making them highly versatile tools for managing various types of risks across organizations. Here are some core features that are commonly found in RMIS:

a. Data Consolidation and Reporting

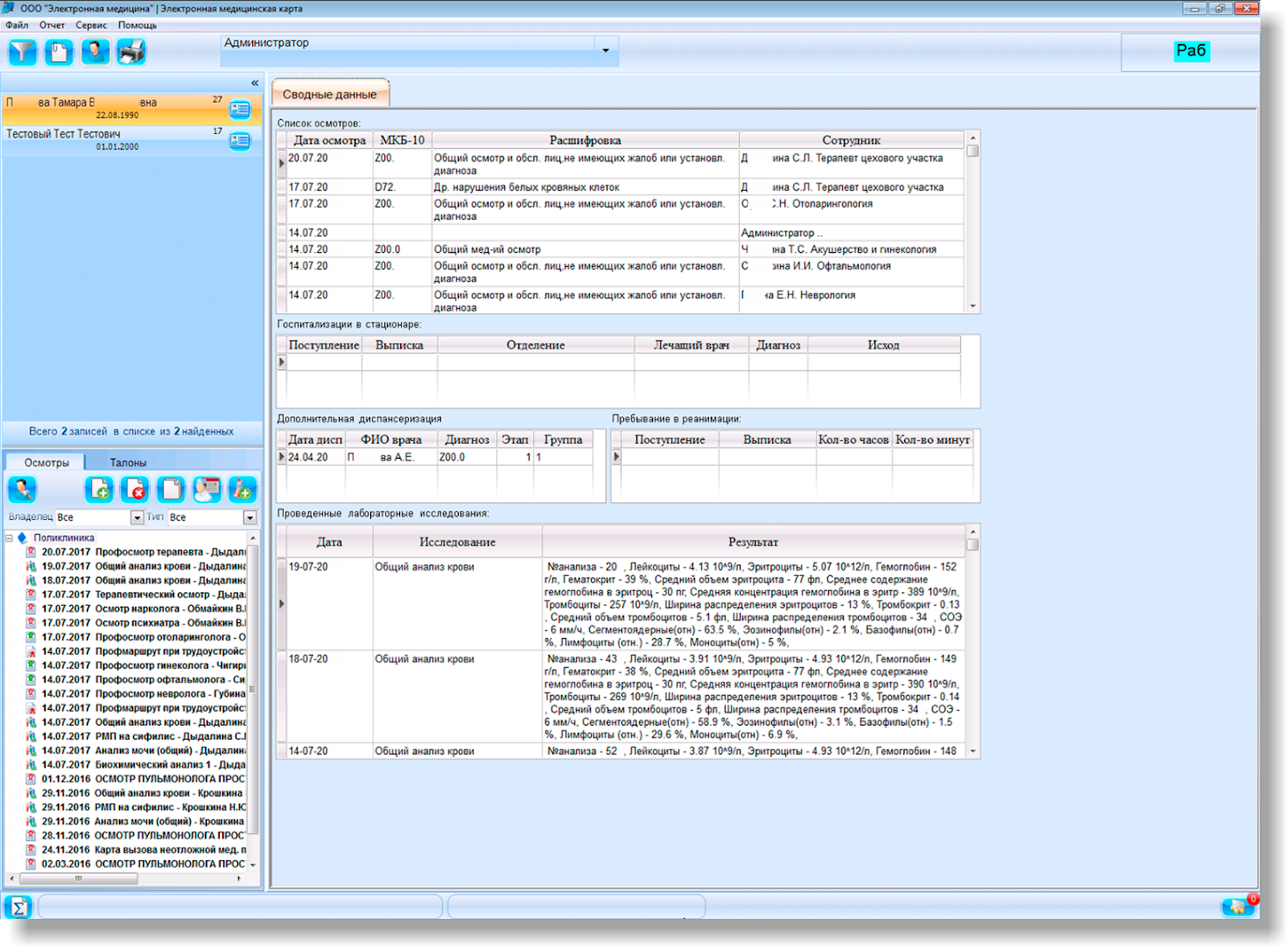

RMIS platforms enable businesses to gather, store, and consolidate risk-related data from multiple sources, including internal reports, external claims data, incident reports, and regulatory updates. This feature allows for robust reporting capabilities, enabling risk managers to generate detailed reports and insights on different types of risks, such as financial, operational, and environmental. The ability to access all risk-related data in one place improves transparency and facilitates data-driven decision-making.

b. Claims Management

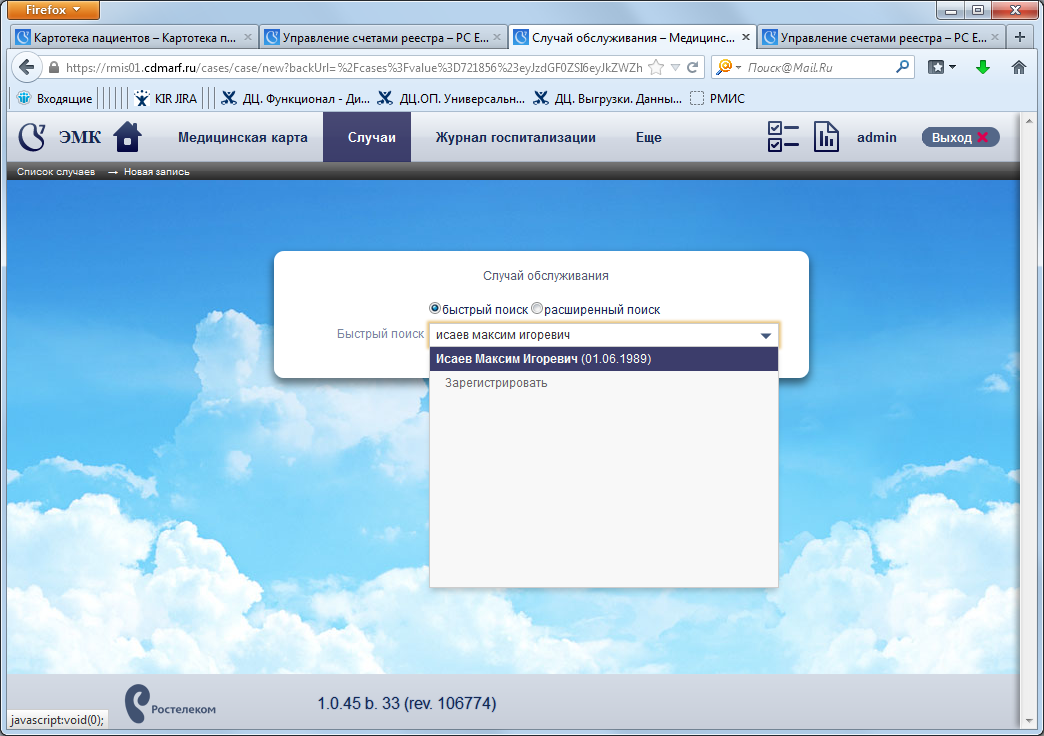

An important aspect of RMIS is its ability to handle claims management effectively. For industries with frequent claims, like insurance, healthcare, and manufacturing, RMIS provides the tools to track, manage, and resolve claims efficiently. RMIS can automate the claims process by sending notifications, tracking claim progress, and ensuring that all necessary information is documented. This feature helps organizations manage claims in a timely and compliant manner, reducing the risk of errors and ensuring that claims are processed accurately.

c. Compliance and Regulatory Tracking

Compliance is a critical aspect of risk management, as non-compliance can result in significant fines and damage to reputation. RMIS platforms often come with compliance tracking features, allowing organizations to stay updated with regulatory requirements. Through automated alerts, RMIS notifies risk managers of changes in regulations and helps ensure that the company’s operations align with legal standards. This feature is particularly important for companies operating in multiple jurisdictions, where regulatory requirements can vary significantly.

d. Incident and Accident Management

For organizations in sectors where accidents and incidents can lead to considerable losses—such as manufacturing, construction, and healthcare—RMIS can play a crucial role in incident management. RMIS platforms can document incidents, analyze their causes, and assess the associated risks. By automating incident tracking and analysis, organizations can improve workplace safety, identify patterns of risks, and implement preventive measures.

e. Risk Assessment and Analysis

RMIS platforms offer advanced tools for assessing and analyzing risks. By using analytics, scenario planning, and modeling techniques, RMIS allows risk managers to evaluate the likelihood and impact of potential risks. This feature is vital for organizations seeking to move from reactive to proactive risk management. By identifying high-risk areas and mitigating risks before they materialize, companies can protect their assets, employees, and reputation.

3. Benefits of Implementing an RMIS

Implementing an RMIS offers numerous advantages to organizations looking to enhance their risk management processes. Here are some of the primary benefits:

a. Increased Efficiency

RMIS improves the efficiency of risk management by automating repetitive tasks, such as data entry, reporting, and compliance tracking. Automation reduces the time and resources needed to manage risks, allowing employees to focus on strategic decision-making rather than administrative tasks. This efficiency is particularly beneficial for large organizations that must manage multiple risks across different locations or business units.

b. Improved Accuracy and Consistency

Manual risk management processes are prone to human error, which can lead to inaccurate assessments and poor decision-making. RMIS ensures that risk-related data is accurate, consistent, and up-to-date, providing risk managers with a reliable foundation for their analyses. Consistency is especially important when dealing with regulatory requirements, as discrepancies can lead to compliance violations and fines.

c. Enhanced Decision-Making

RMIS provides risk managers with access to detailed data and analysis tools, allowing for more informed decision-making. With real-time insights, trend analysis, and risk modeling, risk managers can identify patterns, predict future risks, and develop strategies to mitigate them. This proactive approach to risk management helps organizations anticipate potential challenges and make strategic decisions that align with their overall goals.

d. Regulatory Compliance

Compliance with industry standards and regulations is essential for avoiding penalties and maintaining a good reputation. RMIS platforms support compliance efforts by tracking relevant laws and regulations, ensuring that the organization’s practices meet regulatory standards. Additionally, RMIS can automate documentation and reporting for audits, reducing the risk of non-compliance.

e. Cost Savings

By reducing incidents, improving claims processing, and ensuring compliance, RMIS helps organizations avoid the costs associated with legal fees, fines, and workplace accidents. Additionally, RMIS enables organizations to allocate resources more effectively by identifying areas of high risk and targeting them with preventive measures. This cost-effective approach contributes to an organization’s overall financial health and resilience.

4. Industry Applications of RMIS

RMIS is highly versatile and can be used across various industries to manage industry-specific risks. Here’s a look at how RMIS is applied in key sectors:

a. Insurance

In the insurance industry, RMIS plays a critical role in claims management, underwriting, and risk assessment. Insurance companies use RMIS to automate the processing of claims, ensuring timely and accurate payouts. Additionally, RMIS helps insurers assess risks more effectively, enabling them to set premiums based on accurate data and improve their profitability.

b. Healthcare

Healthcare providers use RMIS to manage risks related to patient safety, regulatory compliance, and data security. By automating incident reporting and compliance tracking, RMIS enables healthcare organizations to improve patient care and reduce legal liabilities. Furthermore, RMIS can help healthcare providers comply with HIPAA regulations and protect patient data from security breaches.

c. Construction and Manufacturing

In construction and manufacturing, RMIS is used to manage safety risks and comply with occupational health and safety regulations. RMIS allows companies to track workplace incidents, monitor compliance, and identify high-risk areas. This proactive approach to safety management reduces the likelihood of accidents, helping companies avoid costly fines and injuries.

d. Financial Services

Financial institutions face a range of risks, including credit, operational, and regulatory risks. RMIS allows banks and other financial service providers to assess these risks accurately and develop mitigation strategies. Additionally, RMIS can support compliance with financial regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) requirements.

5. The Future of RMIS: Emerging Trends and Innovations

As technology continues to evolve, the capabilities of RMIS are expected to expand, making risk management even more efficient and effective. Here are some emerging trends shaping the future of RMIS:

a. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming RMIS by enabling predictive analytics and pattern recognition. By integrating AI, RMIS can identify potential risks before they occur, allowing organizations to implement preventive measures. Machine learning algorithms can also improve over time, making RMIS more accurate and capable of handling complex risk scenarios.

b. Cloud-Based RMIS

Cloud technology is making RMIS more accessible and flexible, enabling organizations to scale their risk management efforts easily. Cloud-based RMIS solutions offer cost savings, enhanced collaboration, and the ability to access data from anywhere, which is particularly beneficial for large or global organizations.

c. Real-Time Data and IoT Integration

The Internet of Things (IoT) is revolutionizing how organizations collect and analyze risk-related data. By integrating IoT with RMIS, companies can monitor risks in real-time. For example, a manufacturing company can use IoT sensors to detect equipment malfunctions and send real-time alerts to RMIS, preventing costly breakdowns.

Conclusion

RMIS has become a crucial tool for organizations seeking to manage risks proactively, enhance compliance, and improve operational efficiency. With its ability to automate complex tasks, provide real-time insights, and support regulatory compliance, RMIS enables companies across various industries to adopt a strategic approach to risk management. As advancements in AI, IoT, and cloud technology continue to drive innovation in RMIS, the future of risk management looks promising, providing organizations with even greater control over potential risks and helping them navigate the complexities of the modern business landscape.