Super Smaller scale Computer, Inc. (NASDAQ:

SMCI) has been a rising star within the innovation segment, capturing consideration with its inclusion in counterfeit insights (AI) foundation and high-performance server arrangements. In spite of its promising direction, SMCI Stock has confronted critical instability in later months, to a great extent driven by outside discussions and inside challenges. This article will investigate the company’s later stock execution, fundamental issues, and long-term development potential, giving a comprehensive examination of what lies ahead for financial specialists.

1. The Rise of Super Micro Computer (SMCI)

Established in 1993, Super Smaller scale Computer at first built up itself as a supplier of high-performance server innovation, catering to segments like undertaking information centers, cloud computing, and AI applications. The company experienced a fleeting rise over the past five a long time, picking up a stunning 3,096% from Admirable 2019 to Admirable 2024

This development was driven by the expanding request for AI framework, particularly in collaboration with major tech players like Nvidia (NASDAQ:

NVDA).SMCI Stock innovation is urgent in fueling generative AI models, a fast-growing segment with colossal showcase potential.

In early 2024, SMCI’s stock come to modern statures, driven by its essential part in AI equipment and computer program environments. The stock surged by over 175% since January 2024, driven to a great extent by financial specialist eagerness around AI applications

By mid-March, the stock hit its top but has since seen critical pullbacks. This vacillation is commonplace of fast-growing tech stocks, but in SMCI Stock case, it has been compounded by outside variables like a questionable report from Hindenburg Investigate, which raised genuine affirmations against the company.

2. The Hindenburg Report: Catalyst for the Drop

In Admirable 2024, SMCI Stock took a critical hit when Hindenburg Investigate distributed a report denouncing the company of different wrongdoings, counting bookkeeping controls, trade control infringement, and self-dealing

The report affirmed that Super Miniaturized scale Computer had been locks in in sanction-dodging trades to Russia and addressed the keenness of certain officials who had been connected to past embarrassments. These affirmations caused a major mix, contributing to a 30% drop within the company’s share cost inside some days.

Whereas the company denied these claims and called the report deluding, the harm had as of now been done. Financial specialists were assist shaken when SMCI Stock postponed its yearly recording with the Securities and Trade Commission (SEC), citing the require for more time to evaluate the adequacy of its inside controls

This arrangement of occasions driven to a wave of downsize from major investigators, counting JPMorgan, which moved its viewpoint from “buy” to “hold”

3. Q4 Earnings Miss and Margin Squeeze

On best of the charges, SMCI Stock monetary Q4 2024 profit report included to financial specialist concerns. Whereas the company detailed noteworthy income development of 143.6% year-over-year, its balanced profit per share (EPS) of $6.25 missed analysts’ desires by 23.2%

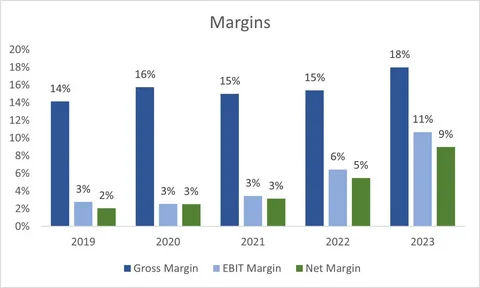

Besides, SMCI’s net edges dropped altogether, from 17% a year prior to fair 11.2% in Q4, reflecting the company’s battles with rising generation costs and supply chain issues.

This sharp decrease in benefit starkly differentiated with CEO Charles Liang’s prior claims of record request for the company’s AI framework arrangements. Investigators had anticipated SMCI Stock to capitalize more productively on the booming AI showcase, but the miss in profit and edge compression driven to a 20% drop within the stock price

4. SMCI’s Response and Forward Guidance

In spite of the later turmoil, SMCI Stock administration has consoled financial specialists by advertising solid forward direction. The company anticipates its financial 2025 income to extend between $6 billion and $7 billion, with balanced EPS gauges between $6.69 and $8.27

These figures point to proceeded development, driven by request for AI and cloud foundation, as well as 5G edge computing arrangements.

To draw in more financial specialists, SMCI Stock too declared a 10-for-1 stock part, planned to require impact in October 2024

Stock parts by and large make offers more reasonable for a broader base of retail financial specialists, and this move is expected to boost liquidity within the showcase. The long-term development prospects for SMCI Stock remain strong, particularly given the company’s indispensably part within the AI insurgency.

5. Key Growth Drivers: AI and IT Infrastructure

One of the greatest variables driving SMCI Stock potential is the hazardous development in AI and IT administrations. Agreeing to industry projections, worldwide incomes from the IT administrations segment are anticipated to swell from $1.42 trillion in 2024 to $1.88 trillion by 2029

Much of this development will be fueled by AI applications, which require the kind of high-performance servers and capacity arrangements that SMCI Stock specializes in.

In addition, Super Micro’s organizations with industry monsters like Nvidia advance cement its position within the AI showcase. Nvidia’s progressed microchips and semiconductors are significant in running complex AI models, and SMCI Stock is well-positioned as a key provider of the servers required to handle these workloads

Also, SMCI Stock is taking steps to extend its generation capacity to meet rising demand. Although this has driven to edge shrinkage within the brief term, the long-term benefits of scaling up are anticipated to drive benefit within the coming years

6. Analyst Outlook: Short-term Volatility, Long-term Growth

In spite of the later headwinds, examiners stay hopeful almost SMCI Stock long-term development prospects. Most examiners covering the stock have kept up a “buy” or “hold” rating, with cost targets recommending critical upside from current levels. The agreement among investigators is that SMCI will proceed to advantage from developing AI selection and the generally computerized change clearing over industries

The 10 investigators who cover SMCI Stock have a middle cost target of around $1,097.78, inferring an upside potential of over 40% from current levels

This idealistic figure is based on desires that SMCI Stock will capture an indeed bigger share of the AI advertise over the another two a long time, expanding its showcase share from 10% to over 17%

7. Risks and Uncertainties

Whereas the long-term viewpoint for SMCI Stock is positive, there are still dangers that seem affect the stock’s execution. The progressing examination encompassing the Hindenburg charges may lead to advance legitimate or administrative challenges, which might weigh on the stock. Also, the company’s dependence on key clients like Nvidia and Tesla might uncover it to dangers on the off chance that those organizations falter

Besides, SMCI Stock later battles with edge compression may proceed in case supply chain disturbances or rising generation costs endure. The company’s capacity to oversee these costs whereas scaling up generation will be basic to keeping up speculator certainty.

8. Conclusion

Super Small scale Computer, Inc. is at a intersection, confronting both noteworthy challenges and surprising openings. The company’s association in AI foundation places it in a prime position to capitalize on one of the foremost transformative advances of our time. In any case, later affirmations and budgetary challenges have presented instability into the stock, leaving speculators questionable within the brief term.

For long-term speculators, SMCI Stock development potential remains intaglio, particularly given the expanding request for AI and IT administrations. The company’s forward direction, combined with its vital stock part, demonstrates that administration is centered on driving future development. Whereas dangers stay, the long-term viewpoint for SMCI recommends that it might be a compelling venture for those willing to climate short-term volatility